Written by Dawn Hurwitz managing editor of the Talk Story program of Puna Rising

Screenshots from zoom meeting and Facebook live

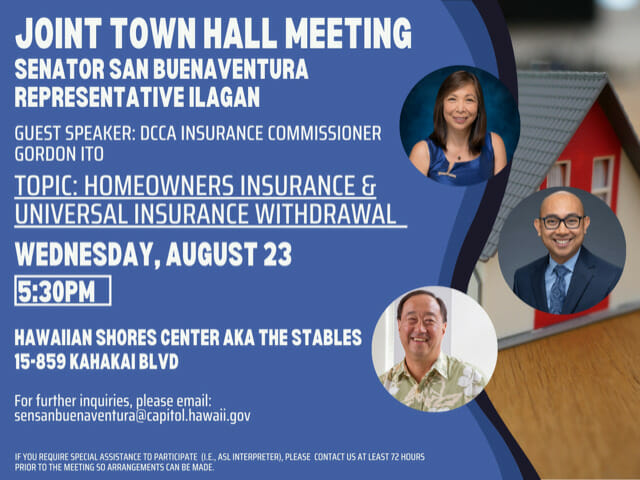

Senator Joy San Buenaventura and Representative Gregor Ilagan along with Eileen O’Hara President of the HOA Hawaiian Shores Recreational Estates tried to wrangle an overflowing crowd at The Stables on Kahakai on August 23. The Town Hall was set to sort out the mystery of the increased cost of homeowners insurance, lack of insurers, and Universal Insurance withdrawing from the market. If you haven’t been in the loop, HPIA which handles the state pool insurance for the underinsured, has been informed that Universal Insurance, one of the few remaining reasonable options, will no longer insure existing policies once they expire beginning September 1, 2023. This will force anyone who wishes to be insured into the HPIA policy which is now quoting skyrocketing premiums.

There were over 80 people who showed up to find out why, with an additional 70 plus on Zoom, as well as a fluctuating 50 plus on Facebook Live. Both Zoom and Facebook had broadcast problems making it difficult to hear questions the audience posed, as well as not understanding what the speakers were presenting.

The presentation was to be anchored by Senator San Buenaventura and Representative Ilagan, with Ilagan taking the lead, however, Ilagan could only attend by Zoom having tested positive for Covid four days prior. Gordon Ito, Department of Commerce and Consumer Affairs (DCCA) Insurance Commissioner as well as Kenneth Hon, Scientist-in-Charge of the Hawaiian Volcano Observatory (HVO) were both asked to make presentations. As Ito had to get back to Honolulu early, he began the presentation, and emotions stirred.

Ito gave much information about how the Insurance Commission came to the conclusion of what the rates would be, citing previous disasters like the 2014 and 2018 lava flows net loss of 5 million dollars which forced them to raise the rates to make back that money. They obviously don’t think we the people are smart enough to do the math. One Facebook viewer remarked if 2000 people paid $250 @ month, that would make up the 5mil- and there are more than 2000 folks paying for insurance.

Ito continued to defend their position offering no further creative solutions or hope, other than if you want to change things, you have to change the law. Not an easy solution as we know the ease or should I say lack of, of how that happens. He also dared to pose the crisis of Maui as a backup to bolster their stand.

Many people had questions they had written down and were told they would be addressed in the future and with emailed responses. A handful of questions were posed from the audience giving each person one minute, yet those questions were inaudible online. This was an informational meeting, not a problem-solving one. There were also many knee-jerk reactions born of the crowd’s frustrations with the information presented.

To further distract, the next presenter was Kenneth Hon of HVO, who gave a clear presentation of the difference between Hazard and Risk as seen in the history of our local volcanic eruptions and where the lava flowed. This was very enlightening surely for the newbies in the neighborhood. He discussed at length the lava zone map of the Big Island showing the hazards of zones 1-9. Citing that it was never intended as a guide for the Insurance companies to calculate risk. By the time he finished his concise presentation, the crowd was better informed about the lava flows, but building frustration with the lack of answers to the insurance crisis.

At that point, Representative Ilagan joined the meeting via Zoom. Many in the room could not hear him for the technical difficulties at hand, but what could be heard from Zoom was enlightening. He hopes to get HPIA to use the USGS map in a more realistic manner. He also hopes to pass a subsidized bill in the next legislative session which would include: Insurers must notify when they are leaving the state, urge HI State and Federal Delegates to include fire insurance for volcanoes, and natural flood insurance would cover the cost. He will report on this in his December Town Hall meeting.

This leaves the rest of us in the settling dust. People are becoming frustrated en masse. The main issue is, with the Universal Insurance company pulling out, folks with a mortgage, are looking at an average cost of approximately $500 per month as their new premium from HPIA. This will surely have people risking foreclosure if they cannot afford it, and people wanting to sell because of the unreasonable costs. It is already beginning to show as a problem with new buyers not being able to afford the insurance and backing out.

This meeting was a good start to a quickly igniting crisis issue. With Universal as just one of the policies here, is that going to be the spark to lead other insurers on the same road? We will unfortunately have to wait and see.

Puna Rising wants to network, connect, and collaborate with all of our Puna neighbors and businesses. Interested in connecting with us? Contact us at punarising.com/contact